Calculating Your Home Tax Bill

The property tax prices are proposed in April of every year primarily based on the budgets ready by the numerous neighborhood governments: counties, cities, college districts, specific districts such as fire protection districts, and so forth. The appraisal districts are accountable for determining the existing market value of all home inside the county, on which tax payments are based. According to some sources, the NMC does have the possible to earn Rs 500 Crore via tax but has hardly managed to scratch that surface.

The property tax prices are proposed in April of every year primarily based on the budgets ready by the numerous neighborhood governments: counties, cities, college districts, specific districts such as fire protection districts, and so forth. The appraisal districts are accountable for determining the existing market value of all home inside the county, on which tax payments are based. According to some sources, the NMC does have the possible to earn Rs 500 Crore via tax but has hardly managed to scratch that surface.

The county’s average powerful home tax price is .95%, 12th highest in the state. Right after figuring out market place worth for the home, the assessed value will be determined by taking the actual value of the home and multiplying it by an assessment rate.

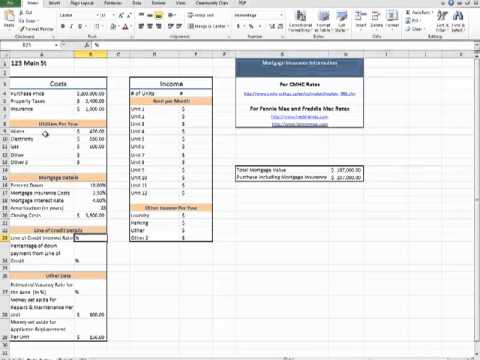

This facility will enable taxpayers to effortlessly access and update their home tax payment information. The table below shows effective property tax prices, as nicely as typical annual property tax payments and average house value, for every county in California.

That ranks fourth in California and ninth in the U.S. Because of those high home values, annual house tax bills for home owners in Santa Clara County are quite higher, regardless …

Calculating Your Home Tax Bill Read More

The house tax estimator will give you an estimate of what your total annual property taxes could be. This valuable tool is intended for the comfort of home owners having said that, you really should bear in mind that it only gives you with an estimate. If the property is not occupied by you because you reside in a different town due to your employment or enterprise,or you reside in another house or rented property in the city of your employment, then you can claim tax exemption on interest payment only up to Rs.two lakh.

The house tax estimator will give you an estimate of what your total annual property taxes could be. This valuable tool is intended for the comfort of home owners having said that, you really should bear in mind that it only gives you with an estimate. If the property is not occupied by you because you reside in a different town due to your employment or enterprise,or you reside in another house or rented property in the city of your employment, then you can claim tax exemption on interest payment only up to Rs.two lakh. True estate properties in the U.S. are taxed by the federal and state governments. In a nation like India, owning home is akin to owning a goldmine, with properties being regarded as the safest and smartest kind of investment currently. Having said that, with half the fiscal year currently behind us, the NMC has barely been capable to hit 12% of their estimated target and have managed to collect a paltry Rs 37 Crore via house tax in Nagpur.

True estate properties in the U.S. are taxed by the federal and state governments. In a nation like India, owning home is akin to owning a goldmine, with properties being regarded as the safest and smartest kind of investment currently. Having said that, with half the fiscal year currently behind us, the NMC has barely been capable to hit 12% of their estimated target and have managed to collect a paltry Rs 37 Crore via house tax in Nagpur. Texas has some of the highest home taxes in the U.S. The average successful house tax rate in the Lone Star State is 1.94%, the 4th highest price of any state. In our instance, if we do not have any other individual home tax liabilities apart from our automobile and our trusts, we’ll just need to pay 350 + 500 = $850. In case if any tax was paid in advance and right after adjusting for the tax for the preceding years, if there is nevertheless a balance, it will be paid back through Cheque or DD right after due verification.

Texas has some of the highest home taxes in the U.S. The average successful house tax rate in the Lone Star State is 1.94%, the 4th highest price of any state. In our instance, if we do not have any other individual home tax liabilities apart from our automobile and our trusts, we’ll just need to pay 350 + 500 = $850. In case if any tax was paid in advance and right after adjusting for the tax for the preceding years, if there is nevertheless a balance, it will be paid back through Cheque or DD right after due verification.

Texas has some of the highest property taxes in the U.S. The average successful property tax price in the Lone Star State is 1.94%, the 4th highest rate of any state. It is expected to recover Rs. 10 crore from big defaulters, while Rs. 15 crore tax is mentioned to be recovered from each residential as nicely as other industrial property defaulters. If the house tax return for the previous year has not been filed, property tax for the current year shall be accompanied with the return and dues, if any for the prior years.

Texas has some of the highest property taxes in the U.S. The average successful property tax price in the Lone Star State is 1.94%, the 4th highest rate of any state. It is expected to recover Rs. 10 crore from big defaulters, while Rs. 15 crore tax is mentioned to be recovered from each residential as nicely as other industrial property defaulters. If the house tax return for the previous year has not been filed, property tax for the current year shall be accompanied with the return and dues, if any for the prior years.