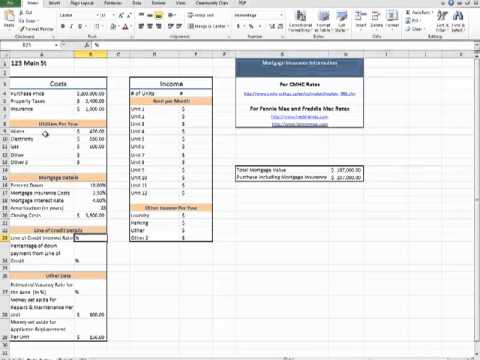

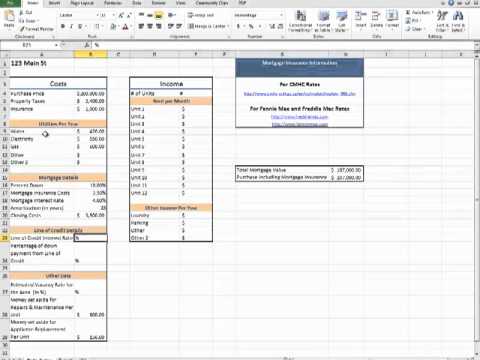

Texas has some of the highest property taxes in the U.S. The average successful property tax price in the Lone Star State is 1.94%, the 4th highest rate of any state. It is expected to recover Rs. 10 crore from big defaulters, while Rs. 15 crore tax is mentioned to be recovered from each residential as nicely as other industrial property defaulters. If the house tax return for the previous year has not been filed, property tax for the current year shall be accompanied with the return and dues, if any for the prior years.

Texas has some of the highest property taxes in the U.S. The average successful property tax price in the Lone Star State is 1.94%, the 4th highest rate of any state. It is expected to recover Rs. 10 crore from big defaulters, while Rs. 15 crore tax is mentioned to be recovered from each residential as nicely as other industrial property defaulters. If the house tax return for the previous year has not been filed, property tax for the current year shall be accompanied with the return and dues, if any for the prior years.

The typical successful property tax price in Harris County is two.three%, double the national typical. Deciding when to spend your taxes may possibly be determined by providing consideration to your present tax circumstance and liability. Sacramento County is situated in northern California and has a population of practically 1.five million.

If you are in a larger tax bracket in 2008 than you are in 2007, you might want to wait and pay your home taxes in January of 2008. Typical home tax for new purchaser (such as Homestead exemption) in 1980: $ 850. Bengaluru, for instance, has recently started enabling home tax payments on the internet.

The typical effective home tax rate in Riverside County is 1.13%, highest in the state. This is needed for your tax records as effectively as displaying proof of payment if the community would ever say you nevertheless owe cash on your taxes Following paying your home tax bill, you can then claim it on that year’s tax return.

Residents have to enter their Exclusive Property Identification Code to update their tax records and opt for either the on the net or offline mode for updates. You have attempted to raise the rents you gather to cover your increasing expenses, but you have not been in a position to hold up to tax and maintenance charges increases.