I Am Promoting My Home, Transfer Tax And Will Cost property tax calculator

property tax estimator indianaHow specifically does your city come up with your property tax worth? In this instance, if you are in the AMT this year but do not anticipate to be in the AMT in 2011, by waiting until January to spend this bill you will save up to 35% in Federal income taxes (39.6% if the “Bush tax cuts” are permitted to expire). This obviously is significantly higher than the two% discount you will forego and the five% penalty you will incur.

It generates both earnings tax deferral and income tax reduction. Revenue tax deferral is successful given that much more depreciation is taken in the early years of actual estate ownership. Earnings tax reduction is obtained given that more revenue is taxed at the capital gains rate (15% maximum versus the ordinary earnings tax rate at 35%). The tax deferral delays the payment of taxes until a …

I Am Promoting My Home, Transfer Tax And Will Cost property tax calculator Read More

To estimate your 2017 municipal taxes, enter the home assessment value from your annual BC Assessment notice in the box below. The typical powerful house tax price in San Diego County is .78%, lower than the national average.However, for the reason that assessed values rise to the obtain price tag when a property is sold, new homeowners can count on to pay higher rates than that.

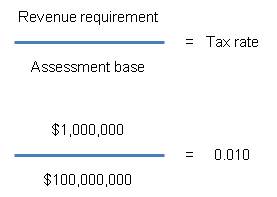

To estimate your 2017 municipal taxes, enter the home assessment value from your annual BC Assessment notice in the box below. The typical powerful house tax price in San Diego County is .78%, lower than the national average.However, for the reason that assessed values rise to the obtain price tag when a property is sold, new homeowners can count on to pay higher rates than that. If you have ever wondered how they come up with the total tax you owe on your Texas house you have come to the suitable place. This calculator is only valid to calculate base taxes just before capping calculations. Mellos-Roos taxes are voted on by house owners and are utilized to assistance unique districts that finance services or improvements. There were also technical glitches which led to some owners paying added tax this year which will be adjusted for the duration of FY 2017-18.

If you have ever wondered how they come up with the total tax you owe on your Texas house you have come to the suitable place. This calculator is only valid to calculate base taxes just before capping calculations. Mellos-Roos taxes are voted on by house owners and are utilized to assistance unique districts that finance services or improvements. There were also technical glitches which led to some owners paying added tax this year which will be adjusted for the duration of FY 2017-18. Please note that rates employed in the House Tax Calculator are primarily based on figures for the taxation year 2017. Initially of all, you will need to go your county distinct tax site and appear up your house. We all know that county and city solutions have not improved in any way to justify 3 and 4 occasions larger tax bills. Property tax has a deep rooted history in India, acquiring a mention in epics like Manu Smriti and Arthasastra, which spoke about diverse tax measures in spot at that time.

Please note that rates employed in the House Tax Calculator are primarily based on figures for the taxation year 2017. Initially of all, you will need to go your county distinct tax site and appear up your house. We all know that county and city solutions have not improved in any way to justify 3 and 4 occasions larger tax bills. Property tax has a deep rooted history in India, acquiring a mention in epics like Manu Smriti and Arthasastra, which spoke about diverse tax measures in spot at that time.