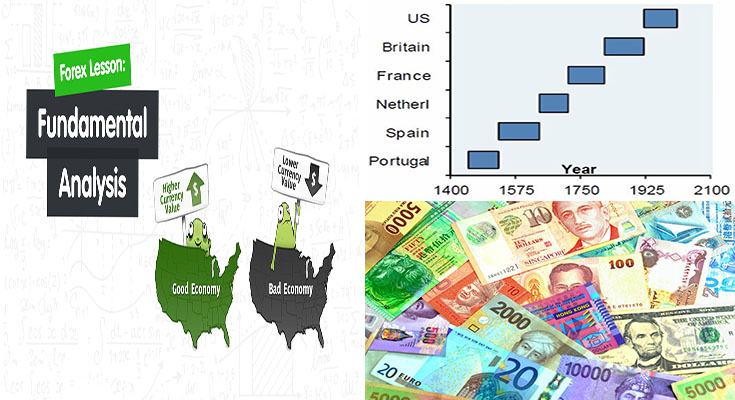

The Fundamentals of Historical Foreign Exchange Rates

The worth of currencies could be the basic basis for figuring out the foreign exchange rate. This market-based mechanism has no upper limit to the appreciation or depreciation of a currency, which causes volatility. Central banks have attempted to regulate currency values, but they have confirmed to be an expensive proposition. Nevertheless, the U.S. dollar remains the benchmark for currency worth, followed by the Japanese yen along with the European euro. Even so, the exchange prices will not be necessarily impacted by these policies.

The first significant advantage of a fixed exchange rate is definitely the stability it supplies. When the worth of a country’s currency is set, the market’s volatility is lowered, creating it simpler for the economy to trade and invest. Additionally, a fixed exchange rate is often a dependable predictor of inflation, which can be specifically crucial for little economies whose GDP is largely derived from external …

The Fundamentals of Historical Foreign Exchange Rates Read More