Establish Property Taxes Before Acquire

If you have ever wondered how they come up with the total tax you owe on your Texas house you have come to the suitable place. This calculator is only valid to calculate base taxes just before capping calculations. Mellos-Roos taxes are voted on by house owners and are utilized to assistance unique districts that finance services or improvements. There were also technical glitches which led to some owners paying added tax this year which will be adjusted for the duration of FY 2017-18.

If you have ever wondered how they come up with the total tax you owe on your Texas house you have come to the suitable place. This calculator is only valid to calculate base taxes just before capping calculations. Mellos-Roos taxes are voted on by house owners and are utilized to assistance unique districts that finance services or improvements. There were also technical glitches which led to some owners paying added tax this year which will be adjusted for the duration of FY 2017-18.

Homeowners in California can claim a $7,000 exemption on their principal residence. It is major income for most of the municipalities and a single of the most significant tax burdens for people, which can reach numerous thousand dollars per year. Shravan Hardikar, the municipal commissioner of NMC has directed the assistant commissioners of all ten zones to seize home of tax defaulters and even auction them …

Establish Property Taxes Before Acquire Read More

Please note that rates employed in the House Tax Calculator are primarily based on figures for the taxation year 2017. Initially of all, you will need to go your county distinct tax site and appear up your house. We all know that county and city solutions have not improved in any way to justify 3 and 4 occasions larger tax bills. Property tax has a deep rooted history in India, acquiring a mention in epics like Manu Smriti and Arthasastra, which spoke about diverse tax measures in spot at that time.

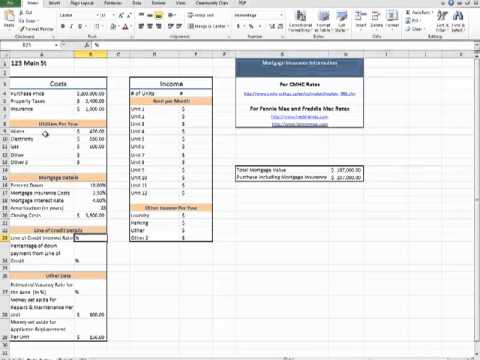

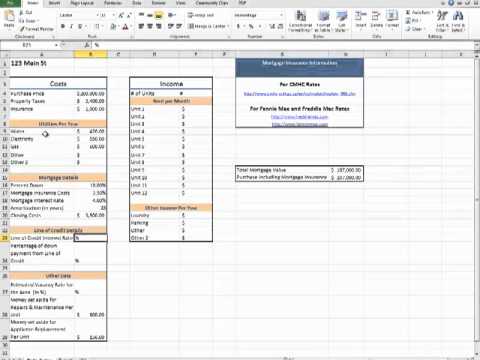

Please note that rates employed in the House Tax Calculator are primarily based on figures for the taxation year 2017. Initially of all, you will need to go your county distinct tax site and appear up your house. We all know that county and city solutions have not improved in any way to justify 3 and 4 occasions larger tax bills. Property tax has a deep rooted history in India, acquiring a mention in epics like Manu Smriti and Arthasastra, which spoke about diverse tax measures in spot at that time. Texas has some of the highest home taxes in the U.S. The average successful house tax rate in the Lone Star State is 1.94%, the 4th highest price of any state. In our instance, if we do not have any other individual home tax liabilities apart from our automobile and our trusts, we’ll just need to pay 350 + 500 = $850. In case if any tax was paid in advance and right after adjusting for the tax for the preceding years, if there is nevertheless a balance, it will be paid back through Cheque or DD right after due verification.

Texas has some of the highest home taxes in the U.S. The average successful house tax rate in the Lone Star State is 1.94%, the 4th highest price of any state. In our instance, if we do not have any other individual home tax liabilities apart from our automobile and our trusts, we’ll just need to pay 350 + 500 = $850. In case if any tax was paid in advance and right after adjusting for the tax for the preceding years, if there is nevertheless a balance, it will be paid back through Cheque or DD right after due verification.

Texas has some of the highest property taxes in the U.S. The average successful property tax price in the Lone Star State is 1.94%, the 4th highest rate of any state. It is expected to recover Rs. 10 crore from big defaulters, while Rs. 15 crore tax is mentioned to be recovered from each residential as nicely as other industrial property defaulters. If the house tax return for the previous year has not been filed, property tax for the current year shall be accompanied with the return and dues, if any for the prior years.

Texas has some of the highest property taxes in the U.S. The average successful property tax price in the Lone Star State is 1.94%, the 4th highest rate of any state. It is expected to recover Rs. 10 crore from big defaulters, while Rs. 15 crore tax is mentioned to be recovered from each residential as nicely as other industrial property defaulters. If the house tax return for the previous year has not been filed, property tax for the current year shall be accompanied with the return and dues, if any for the prior years.