Financial Services Industry Trends

The financial services industry covers a wide array of activities. The financial services industry comprises all those aspects of business activity that deal with the financial transactions of individuals or corporations. These activities are the following: financial planning and advice, investment, banking, insurance, asset management, tax, and financial markets. The financial services industry offers a wide variety of jobs to individuals and companies. It provides employment opportunities in all areas of financial services.

The Growth Could Be Predicted

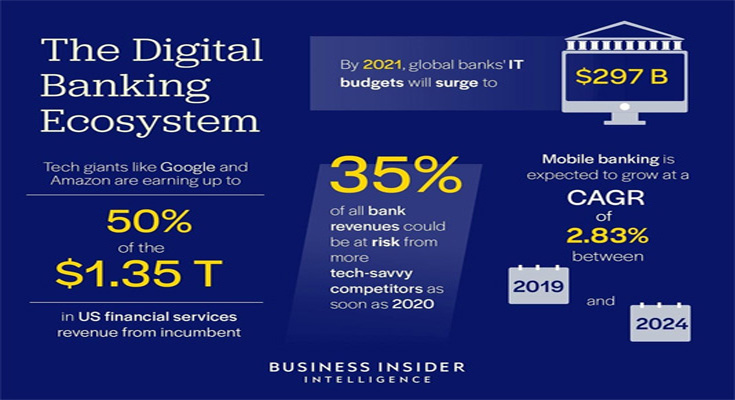

The financial services industry growth can be predicted using the financial services industry trends and forecasts. The financial services industry trends cover all the aspects of business activity including investment banking, brokerage, stock brokerages, asset management, financial markets, insurance, and securities. Some of the financial services industry trends and forecasts include the following: the number of jobs in financial services will increase steadily. Demand for financial services will increase in the corporate …

Financial Services Industry Trends Read More