The foreign exchange rate is the value of one currency in a further country’s currency. Most currencies are traded on the foreign exchange marketplace, that is open twenty-four hours a day. By 2021, the market is anticipated to trade $6.six trillion each day. Some countries have a fixed exchange rate, although others have continually fluctuating prices. If you are enthusiastic about the history of foreign currency exchange, read on to study extra about how the FX market place performs.

The True Exchange Rate

It will be the value of one currency relative to a different currency. The actual exchange rate reflects the existing worth of your local currency. It shows the number of units expected to buy a market place basket of goods and services in a distinctive country. The nominal rate does not take inflation into account. Hence, the real exchange rate is far more valuable to investors. However, it is generally vital to keep in mind that the official foreign exchange rates are generally different from those on the secondary market.

To understand how the foreign exchange rate works, we should really appear in the definition of every currency. Inside the United states of America, the dollar may be the most generally traded currency and accounts for about 87% from the total value traded every day. Whilst it is accurate that the value with the US dollar has enhanced more than the past three years, the value with the Euro continues to be 25% greater. Generally, the US dollar will appreciate greater than the Euro in three years, however the Euro is still worth greater than a dollar.

The Foreign Exchange Rate is Also Called the Selling Rate

The selling rate is the price tag that the bank sets for any specific foreign currency. This really is the amount which you must pay when selling foreign currency. In contrast, the middle rate will be the average with the two quotes. In other words, the basic exchange rate is constantly quoted against the US dollar. Inside a cross-border transaction, the value of one currency is primarily based around the worth of another country’s currency.

On the planet of foreign exchange, the promoting rate will be the price a bank sells a currency for another. This cost represents the worth with the currency of the country you are selling. It really is the quantity that you just need to invest in order to get a specific quantity of the foreign exchange. The selling rate may be the selling cost of your currency. The shopping for and also the sales of currencies are both determined by the selling and buying costs. The asking as well as the middle rates will be the exact same.

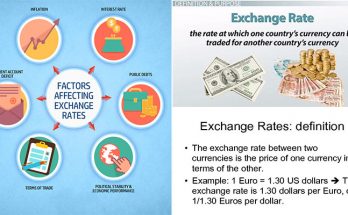

The foreign exchange rate is influenced by many things, such as political and economic circumstances. Whilst there are numerous aspects that may influence the marketplace, the principle ones are government policies, psychological conditions, along with the outlook for the economy. For example, in Argentina, restrictions around the export of foreign currency have been reinstated plus the country’s currency exchange rate fell. Further, in 2003, the country’s government had to resume its import and export activities, which led to a decline in its GDP.

The Promoting Rate is the Cost at Which a Nation Sells Its Currency

The purchasing and selling rates in the retail currency exchange industry are different, which makes it hard to examine them. As an example, when you obtain a currency from yet another country, it’s essential to bear in mind that the selling and shopping for prices are determined by the selling and getting prices of the currency. In the retail market place, the promoting and buying prices would be the same. The purchasing and also the sale rates of the currencies are also various.

The promoting rate will be the value a nation pays for its currency whenever you sell it. It really is also referred to as the getting rate. This refers towards the price tag someone pays to purchase a foreign currency. The promoting and buying costs are the similar. If you purchase 1 currency, you should sell the other 1. If you need to sell it, you should spend the obtaining value together with the other currency. You could possibly require to get a distinctive currency to avoid the threat of losing extra money.

Be the Price Tag

The foreign exchange rate may be the price tag of a domestic currency in a different country’s currency. It compares two currencies. Each currency has its own value. A foreign currency can be a commodity, which is primarily based on the price tag on the product. The price tag of a item in the US dollar varies from nation to nation, and it truly is dependent around the supply and demand of a country. Its value is impacted by the prices of other commodities.