The Foreign Exchange Rate will be the current price of 1 currency against another. Usually, this exchange rate is determined in the eleven o’clock London time and may be viewed on the Reuters Globe Currency Web page. Often, currencies fluctuate quite a little, and it’s important to understand what it signifies for the investment portfolio. To know the current value of a currency, it truly is helpful to understand a bit about how currencies are valued.

A Currency’s Value is Defined by Its Exchange Rate

The current price of one currency against another determines the relative value of a country’s currency. The nominal exchange rate would be the quantity of income needed to purchase a marketplace basket of goods within a foreign country. In contrast, the genuine exchange rate will be the amount of revenue necessary to get a market place basket of goods in a different nation. A genuine exchange prices takes into account price differences and is more relevant for tiny economies.

The Selling Rate is Also Known as the Foreign Exchange Promoting Price

It truly is the price a bank will ask for your currency after you sell it for its own currency. It indicates the level of currency you’ll want to sell so as to acquire a profit whenever you sell foreign currency. A middle rate is often a widespread term utilized in newspapers and magazines and economic evaluation. A middle rate will be the average on the asking and bid prices. The dollar has been growing in worth in the last three years, even though the Euro remains 25% much less worthwhile than its European counterpart.

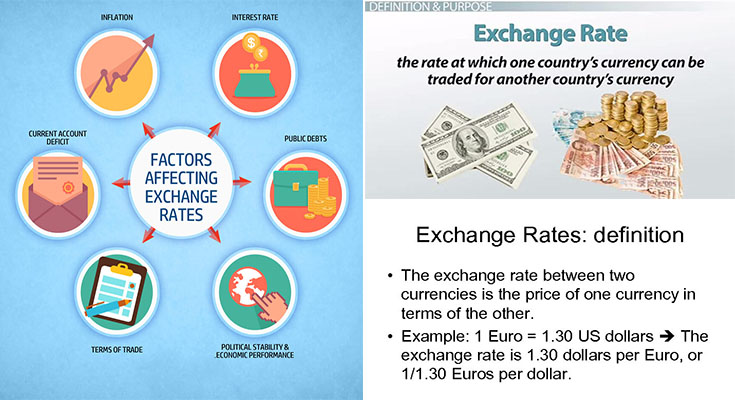

You will discover many different elements that impact the foreign exchange rate. No matter if a country’s currency is usually a dollar or perhaps a euro, it depends on the country’s monetary policy. A modify in interest rates in one nation could lead traders to buy the dollar against the euro. The euro value could possibly fall because the traders’ expectations of a monetary policy shift transform. A country’s currency can also have two distinctive rates. These are known as the onshore and offshore prices.

Generally, a nation’s currency’s worth is based on its price in relation to another nation’s currency. The selling rate could be the price that a bank would charge to sell a currency to a foreigner. Similarly, the purchasing rate is the price of a currency in its country’s national currencies. When the demand for the foreign exchange is high, the purchaser will buy the currency. It is a very good notion to verify the promoting rate before you purchase.

It is Also Feasible to Discover an Additional Favorable Rate Within a Nation

You’ll be able to use a currency calculator to create an informed selection. Generally, a country’s foreign exchange rate is influenced by several elements, such as economic circumstances, government policy, and psychological circumstances. Nonetheless, some nations have restricted currency exchange rates. Based on the location of your travel, you may usually discover a lot of advantageous exchange prices inside a country’s borders.