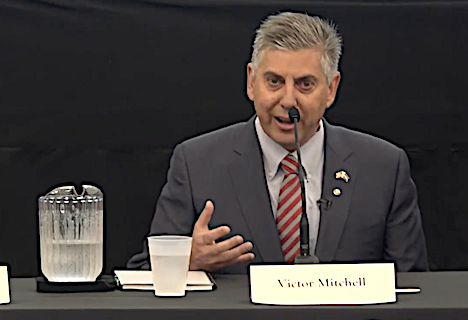

CEO of Lead Funding, Victor Mitchell, Lists 9 Common Mistakes When Starting a New Business

Starting up a new business is always a challenge, demonstrated by the fact that approximately 50% of new businesses will fail within the first five years. Knowing what the common mistakes are that result in business failure can help new entrepreneurs ensure that they avoid the same mistakes, allowing their organization to grow and thrive. Successful businessman and life-long entrepreneur, Victor Mitchell, lists some of the most common mistakes new business owners make:

Choosing the wrong business structure. Many new business owners will start as sole proprietorships, as there’s less administrative hassle. However, LLCs and corporations are much more robust and can protect personal assets from liability. Smart business owners will consult many resources before settling on the best fit for their enterprise.

Doing everything alone. Many new entrepreneurs fall into the trap of taking on all the roles of the company themselves, leading to burnout and a failed …

CEO of Lead Funding, Victor Mitchell, Lists 9 Common Mistakes When Starting a New Business Read More

It’s now less than a year until businesses that file VAT returns will need to do so online via accountancy software. Apart of the Making Tax Digital (MTD) programme, the initiative means some 2.5 million VAT registered businesses in the UK with a turnover exceeding £85,000 will need to submit their VAT returns through software compliant with that of MTD rather than through the HMRC portal.

It’s now less than a year until businesses that file VAT returns will need to do so online via accountancy software. Apart of the Making Tax Digital (MTD) programme, the initiative means some 2.5 million VAT registered businesses in the UK with a turnover exceeding £85,000 will need to submit their VAT returns through software compliant with that of MTD rather than through the HMRC portal.