The financial services industry covers a wide array of activities. The financial services industry comprises all those aspects of business activity that deal with the financial transactions of individuals or corporations. These activities are the following: financial planning and advice, investment, banking, insurance, asset management, tax, and financial markets. The financial services industry offers a wide variety of jobs to individuals and companies. It provides employment opportunities in all areas of financial services.

The Growth Could Be Predicted

The financial services industry growth can be predicted using the financial services industry trends and forecasts. The financial services industry trends cover all the aspects of business activity including investment banking, brokerage, stock brokerages, asset management, financial markets, insurance, and securities. Some of the financial services industry trends and forecasts include the following: the number of jobs in financial services will increase steadily. Demand for financial services will increase in the corporate sector. The financial services industry will continue to expand globally.

The financial services industry overview and forecast provide data on the number of banks, building societies, savings and loan associations, consumer credit companies, and other financial institutions. These institutions have total assets exceeding US $ Trillion. Most of these financial institutions are American, European, Asian, and Latin American. There are only a few banks which are located in the Middle East.

Financial services industry trends and forecasts also provide data on the future outlook of this industry. The future growth of this sector depends on various factors such as general economic conditions, the generation of population, rates of growth in technology, and globalization. Data on these factors help to determine the future scope and size of this sector.

The financial services industry trends and forecasts indicate that there will be strong growth in Asia, particularly in the Asia-Pacific region. The economies of these countries are growing at a rapid pace. This is accompanied by a high population. The growth rate of this continent is very high. As a result, the number of people aged between 15 years and 30 years is also increasing. As a result, this continent will witness a sharp rise in the demand for financial products.

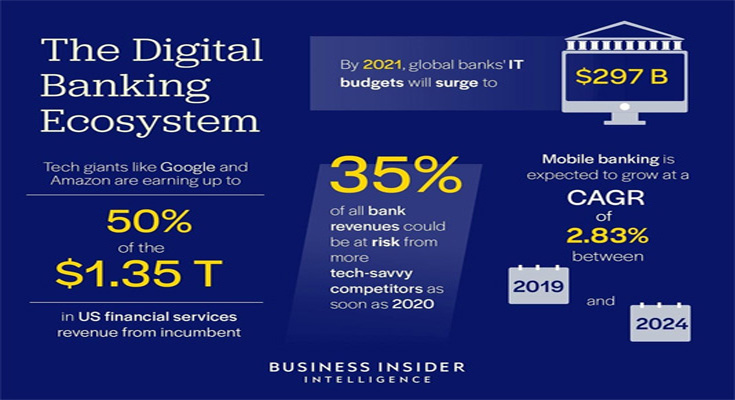

Financial services industry trends and forecasts also predict that there will be significant growth in the usage of digital devices and online banking in the next five years. In this context, the use of data analytics will play an important role. Data analytics will help banks to use real-time customer experience information provided by customers to make effective decisions. By using this information, the banks can plan and develop customer service programs for the future.

The Use Of Big Data Analytics

It will help financial services companies to take their business to the next level. This is because financial services companies use artificial intelligence (AI) to help them understand customer needs and make appropriate changes in their strategies. Financial services companies are using artificial intelligence to help them understand customer needs and make appropriate changes in their strategies. Artificial intelligence will help these companies to improve customer service, which in turn will increase sales and reduce operational costs.

Moreover, financial advisors should make sure they have access to accurate and up-to-date information. It is highly advisable to make use of cloud computing technologies to streamline data management. Furthermore, a financial advisor should also develop a business intelligence system to track all incoming and outgoing business. The main business goal should be to reduce business costs through a comprehensive strategy. Therefore, a financial advisor should take all steps necessary to meet their financial goals and objectives.