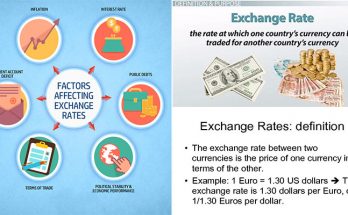

The worth of currencies could be the basic basis for figuring out the foreign exchange rate. This market-based mechanism has no upper limit to the appreciation or depreciation of a currency, which causes volatility. Central banks have attempted to regulate currency values, but they have confirmed to be an expensive proposition. Nevertheless, the U.S. dollar remains the benchmark for currency worth, followed by the Japanese yen along with the European euro. Even so, the exchange prices will not be necessarily impacted by these policies.

The first significant advantage of a fixed exchange rate is definitely the stability it supplies. When the worth of a country’s currency is set, the market’s volatility is lowered, creating it simpler for the economy to trade and invest. Additionally, a fixed exchange rate is often a dependable predictor of inflation, which can be specifically crucial for little economies whose GDP is largely derived from external trade.

Thus, the federal reserve bank encourages the usage of fixed exchange prices in foreign exchange trading.

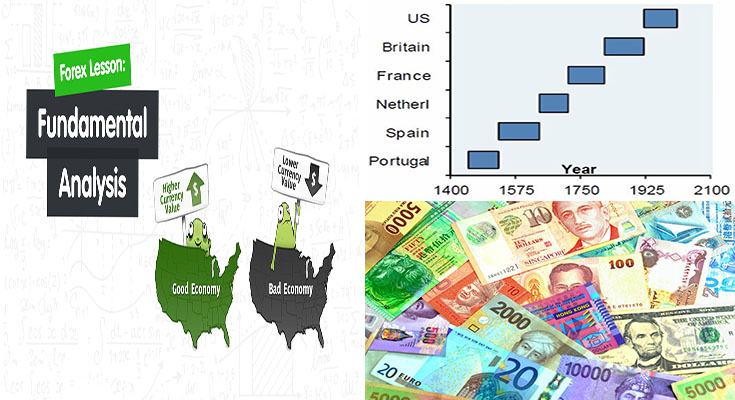

When an economy is experiencing financial growth, the currency is probably to appreciate in worth. You will discover quite a few variables that have an effect on the value of currencies. On the list of most important could be the strength of the U.S. dollar. This can be the most widespread currency, nevertheless it can also be the most volatile. A country’s currency worth can go up or down, based on the strength from the U.S. dollar, too because the stability of its economic system.

Furthermore, to political and economic components, the exchange rate can be impacted by psychological factors. Depending around the kind of currency along with the country, the exchange rate can go up or down. As an example, a country’s Y=114 along with a US$1 is $1/114. The cost of a dollar is equal to its Y=114. The price of a yen when it comes to the US dollar would be the exact same because the value of a dollar.

There are various things that influence the foreign exchange rate. Government policies and also the circumstances in other nations can influence the worth on the currency. In addition, the Federal Reserve Banks in the world also regulate the exchange rates of currencies. These factors can affect the worth of any currency in the world. The U.S. dollar’s exchange rate is determined by the Federal Reserve, which sets and maintains the rate of the dollar. Unlike the U.S. dollar, the Canadian dollar’s exchange rate is hugely volatile. A country’s foreign exchange rate is determined by a variety of components. It can be either versatile or fixed, based around the currency and also the country. It might be characterized as a “fixed” or even a “flexible” currency. Frequently, versatile currencies might be accompanied by powerful or weak exchange rates. The former will be greater than the latter. These currencies are in comparison with one an additional by a government-regulated marketplace.