How to Perform a Cointegration Test in EViews: A Step-by-Step Guide

In time series econometrics, cointegration is a critical concept. It establishes a long-run equilibrium relationship between two or more non-stationary time series variables, meaning that even if they drift apart in the short run, they will eventually move back toward a shared, stable relationship.

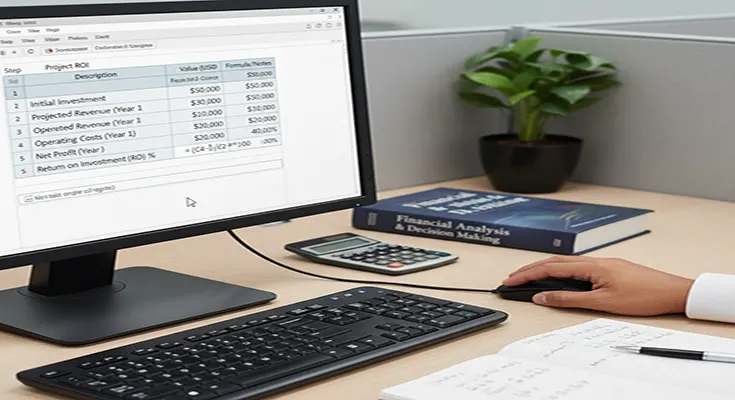

EViews, a popular statistical software package, provides powerful tools, primarily the Johansen Cointegration Test, to detect this relationship. This guide walks you through the necessary pre-tests and the steps for performing the test in EViews.

Phase 1: Pre-Testing—Checking for Unit Roots

Before you can test for cointegration, you must confirm that all your variables are non-stationary and are integrated of the same order, typically I(1) (stationary after one difference). If the variables are stationary at their levels (I(0)), you do not need a cointegration test; you can proceed directly with standard Ordinary Least Squares (OLS) regression.

1. Perform the Unit Root Test (ADF)

- Open