What You Must Find Out About Work: Advice and Tips

Are you currently away from operate? Are you presently looking for dollars to care for your financial situation? You don’t really need to be one, although there are presently huge numbers of people who are out from operate. The next article includes recommendations that will help you get yourself a task.

You need to dress well on your talk to. This is correct even for an informal business. You’re trying to amaze a person employing, so prove to them what you really are able to.

When evaluating a job try to look for the one that fits your personality type. As an example, if you are shy and like taking care of projects by yourself, a job which requires anyone to be part of, and contribute to a more substantial crew may be a terrible decision. Cautiously evaluate what you are about, and locate employment that fits that completely.

If you are searching to maneuver up within a firm don’t be bashful to talk to control once you have a perception. At the same time, don’t overdo it. By proceeding their with sincerely very good ideas which you think will assist the corporation, they are going to normally would love …

What You Must Find Out About Work: Advice and Tips Read More

Tax accountants are often subject to the question “What is the cost of hiring a CPA?” It is almost similar to the question “What is the cost of a home?” Just a 1000 sq.-feet home which is located in Arizona will be different from a same sized home located in New York, such is the concept of hiring a CPA. There can’t be any definite answer to how much a CPA will cost. It depends.

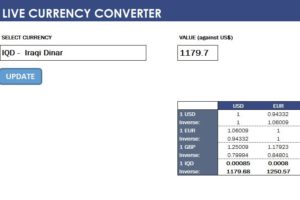

Tax accountants are often subject to the question “What is the cost of hiring a CPA?” It is almost similar to the question “What is the cost of a home?” Just a 1000 sq.-feet home which is located in Arizona will be different from a same sized home located in New York, such is the concept of hiring a CPA. There can’t be any definite answer to how much a CPA will cost. It depends. Effortlessly calculate currency conversions between extra than 200 world currencies, plus all the old legacy European currencies, some globe legacy currencies and even unrecognized currencies and virtual currencies (like the Linden Dollar from Second Life). The pivot currency serves as the only specified reporting currency in the reporting currency example, the pivot currency can be set to United States dollars (USD), and the fact table retailers transactions in euros (EUR), Australian dollars (AUD), and Mexican pesos (MXN).

Effortlessly calculate currency conversions between extra than 200 world currencies, plus all the old legacy European currencies, some globe legacy currencies and even unrecognized currencies and virtual currencies (like the Linden Dollar from Second Life). The pivot currency serves as the only specified reporting currency in the reporting currency example, the pivot currency can be set to United States dollars (USD), and the fact table retailers transactions in euros (EUR), Australian dollars (AUD), and Mexican pesos (MXN).